The

Bullish take: After many an banking

analysts has loaded up on their warnings that the euphoric burdened market is due for a correction

to ease some of the massive retail euphoria (some of that froth and euphoria significantly

has shifter these past few weeks to squeezing the shorts within the most

shorted stocks hard-to-borrow plays), a renown self-serving bullish hypster ,

one of the herd’s [talking up his own book] biggest permabulls, did just that

when JPM's Kolanovic

urged investors to ignore warnings about a the mega bubble (On Wednesday) I

have been warning you all about incessantly!

As despite clear evidence of a mega bubble everywhere you look, he

stated to just buy the dip like Pavlov’s conditioned trading-bots-dogs on any selling

from the feud between retail investors and hedge funds. Conceding that we have “seen

a number of strategists calling for a market correction or indicating equities

are in a bubble” coupled with recent “turmoil related to trading activity in

small highly shorted stocks” the JPM quant so called guru disagreed strongly and

said that professional investors are far from bullish, as the firm’s

model tracking computer-driven strategies to stock-picking funds shows their

equity positioning sat in the 30th percentile of a 15-year range (which,

of course, is a reason that the VIX remains remarkably sticky and volatility control

strategies simply have not been able to leverage up to historical levels, but

we should not expect Kolanovic to dwell too much on what's really going on if

there is an JPM agenda to be promoted). Nevertheless, according to the Kolanovic,

there are 3 main reasons for the firm's (perpetually) rosy outlook:

- Ø Overall

equity positioning is low in a long-term historical context, and they expect it

to increase!

- Ø We

expect the Covid-19 pandemic to rapidly subside on the back of vaccines and

population immunity (which they believe has already started to happen)!

- Ø They

expect monetary and fiscal support to remain in place and grow substantially

(on tis I agree) likely driving increased consumption, global trade, and demand

for goods, thus supporting higher inflation (something that I do not agree with).

“In that light”, Kolanovic notes, “any market pullback, such

as one driven by repositioning by a segment of the long-short community (and

related to stocks of insignificant size), is a buying opportunity, in our view.” He then provided some more detail behind his

three core views, starting with his view how funds apparently are not that

bullish, despite this week’s mauling of the most popular hedge fund positions

which are being dumped in masse ahead of upcoming anticipated liquidations to likely

meet margin calls; Positioning across risky asset classes, and in particular in

equities and commodities, in a long-term historical context is low. Also

that 2021 should be a transformative year of Covid-19 recovery!

Ironically, in a week when stocks were smacked around and

the VIX is

rising above 33 on its way I believe to 39.00 then 46.75, Kolanovic once again

goes against the grain and expects the VIX to magically drop just because: Ge stated that “We

expect the VIX to decline into the mid-to-high teens and positioning,

accordingly, to increase from the ~30th to ~60th historical

percentile. He went on to state that realized volatility has already declined

significantly (SPX-500 realized volatility ~10 vs VIX ~25 is

a near-record spread). Given the low levels of inflation over the past decade,

global trade war, and recent pandemic, the exposure of investors to equities

and inflation protecting assets such as commodities is also very-low (as compared

to pre-Great Financial Crisis era). Of course, if the VIX does

not decline but keeps rising, expect as Clubber Lang stated to Rocky “expect pain”.

He then focused on the pandemic and clearly ignoring the warnings that mutant Covid-19

mutating strains will become a real medical drain over the globe and will hit here

in the US as well, as such he wrote that he expects the global Covid-19

pandemic “to decline rapidly in the coming weeks.” He believes the

increase in cases and deaths over the past few months was “Holiday exposures” and

the beginning of large-scale vaccination programs in the US, [the current

vaccination pace is to approximate 1-million vaccines a day]. And given the

estimation of natural immunity (cumulative cases), current pace of vaccination,

as well as other considerations (e.g., the impact of warmer weather, variation

in susceptibility here), he expects the pandemic to effectively end in 2021/Q2.

In addition to the positive impacts of the above drivers, there is also a

positive feedback loop between them, which he believes will lead to a rapid

decline in hospitalizations and enable a mega fast reopening of economies this

spring (I wonder how many businesses will still be standing).

ü The

only question is whether the new administration will help him to become right,

or will lockdowns have to extended in hopes of getting even more stimulus from

Congress/Powell.

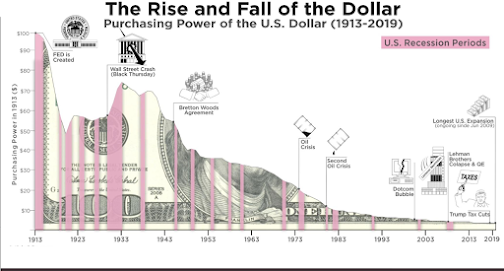

He focused on the source of the bubble (but there is no

bubble in his opinion) just a very real bullish move, due to Fiscal and Central

Banker manipulation 😊. He writes that they

should “remain very accommodative given the elevated unemployment levels and

over a decade of low inflation running below their targets.” He' might be somewhat

right as almost all central bankers including our FED are trapped and they can never

again tighten or else they will unleash the mother of all stock market tantrums

that could lead to a serious implosion. It is also likely why the FED recently

revised their entire “BS” inflationary framework, effectively giving itself a huge

proverbial greenlight to keep injecting over $120 billion

per month of liquidity (Buying

new-debt bonds from the massive deficit debt) in perpetuity even if home prices

are surging by over 10% annually [creating another mega housing bubble in my

opinion] as they are now. He went on to note that “fiscal support for individuals

and businesses harmed by the pandemic will also likely continue and be a

significant driver” [a likely driver of the most shorted stocks that we have been

seeing of late as the new stimulus is gambled via the stock market)

He went on to states that “the monetary and fiscal backdrop

of 2021, along with the strong recovery from Covid-19 and relatively low positioning

in risky assets, should be a huge positive for stocks and commodities and

negative for bonds.” His conclusion: “short-term turmoil, such as the one this week, are

opportunities to rotate from bonds to equities.” Then at the end of

the report he then admits that while his view is positive, we do acknowledge

that some market segments are most likely in a bubble. This is a result of

excessive speculation (including but not limited to retail investing) as well

as perceived benefits for these segments from the Covid-19 pandemic and related

political trends.

I am seeing massive signs across the market of speculative

excess are everywhere. Penny stocks soaring like moonshots. Cash has been pouring

into trendy solar and EV bets; huge risky debt paying

less than ever; huge gains in zombie stocks these unhindered and unrestricted animal

spirits and historic valuations levels bear-watching 😊 as it

is imprudent to hope and pray that there is a greater fool lurking out there

for you to unload to it you keep buying at these nose-bleed levels! Retail

traders are currently fueling the most speculative trading strategies, the

market for new issues (IPO’s and SPAC’s) is booming, while short interest in the SPY is near decade lows.

Data has consistently shown that overall stock buying rose after

the last round of pandemic-relief checks was issued, and it was not just the

retail crowd. A record number of investors with ~$560 billion overall say that

they think they are taking significantly higher-than-normal levels of risk,

according to Bank of America’s latest survey “Are there any bears left?” Even Goldman

Sachs says “unsustainable

excess” is evident in very high-growth, high-multiple stocks and across

special-purpose acquisition firms, or SPACs.

That is the same view echoed by Citigroup however they diverged saying weighed

global equity prices on both a relative and historic basis and concluded even

expensive U.S. shares could have more room to run. “We would never advise

anybody to chase a bubble,” they wrote on Friday. “It could burst at any time.

But if CAPEs were to hit previous highs then the U.S. indices could

go up significantly higher!”

Incessant hot IPOs, a rise in thematic

investments [Thematic

investing is a form of investment which aims to identify macro-level trends,

and the underlying investments that stand to benefit from the materialization of

those trends. a renewed boom in day-trader activity and “dramatic

runs” in EV’s, Solar and cryptocurrencies are all reasons why bubble anxieties

have emerged, JPMorgan strategists led by Mislav Matejka wrote in a research note

this past week...In a market awash with “excess” central bank liquidity, it is

a debate that will continue to rage. One aspect of that debate is the risk the

same reflation trade boosting stocks comes with a sting in the ass for debt

investors.

With benchmark treasury yields failing to break above 1.2%, hosts

of investment-grade debt offer yields near

or below zero. History has shown me in

the past that money can be made as mega bubbles inflate. However, we will not be able to evade a real bear market that will

come, but before then markets may get more frothy before logic and reality sets

in.

Today this market in my opinion is very-very

euphoric and 90% of the easy and prudent LONG-side money

has likely been made already, there are few opportunities I like, to make long-side

longer-term money you have got to find a proverbial Goldilocks environment.

Please note: “hedge fund short sellers” an “NEW” abundance

of US household bailout stimulus payments could continue to fuel the recent

retail trading boom. The equity market peaked in 2000 and this occurred

following a year in which household credit

card debt rose by 5.3% and real consumer checking

deposits declined, then bang during 2020 credit card debt declined by more than

10%, checking deposits grew by $4.2 trillion, and savings grew by $5.1 trillion.

On top of these savings, many economists expect more than $1 trillion in additional

fiscal support in coming months, including another round of direct checks.

Although the level of net margin debt currently represents 0.9% of US equity market

cap, similar to the 1.0% share in 2000, it reached 1.2% in 2018. And the 35%

increase in margin debt during the past 12 months pales in comparison to the

150% rise we saw in 1999!